Our insights

Head of Investment Office Jon Cunliffe and Fund Manager James Godrich discuss the latest market update.

Manager of JM Finn’s Inheritance Tax Portfolio Service, Andrew Banks, suggests that the announcements about Business Relief in the Autumn budget are positive for smaller companies.

Investment Director Lucy Coutts and Head of Wealth Planning Anna Murdock offer their initial opinion of the Autumn Budget.

Jon Cunliffe, Head of JM Finn’ s Investment Office, reviews the third quarter and looks ahead in a world of aligned fiscal and monetary policy.

As the UK waits for the outcome of the Autumn Budget next week, will Labour's policies be enough to assure UK investors of their ability to create long-term economic growth?

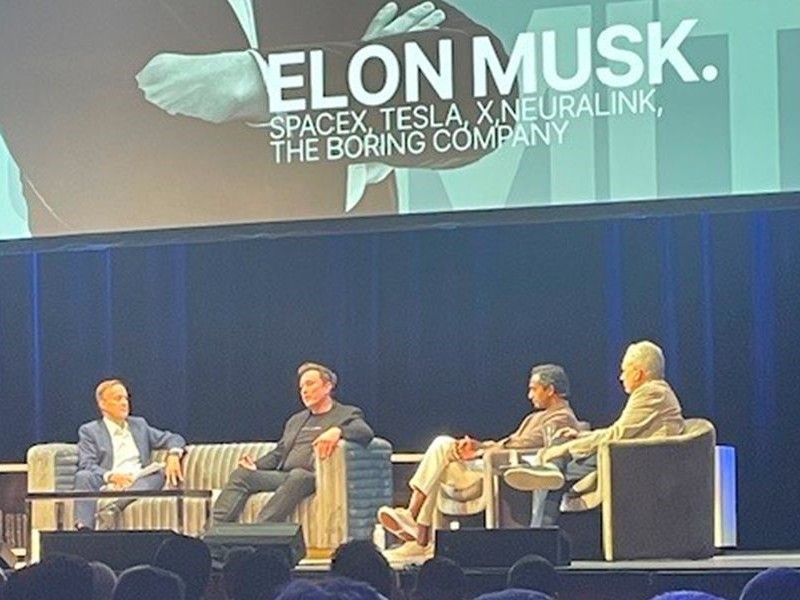

Can regulation match the extraordinary rate of progress in AI? That is the question posed by the most world's powerful figures in tech at the 2024 All-In Summit in California. Read our special report…

Our CEO is featured once again among Spear’s compilation of the top 100 movers and shakers in the world of wealth management.

The £5,000 award supports an outstanding graduate artist to nurture their fledgling career through funding for studio fees.

Uncertainty over the Budget and Labour policies is dampening enthusiasm for UK shares, writes Investment Director Andrew Mann.

We are among finalists, having won Best Wealth Manager in 2023, 2022 and 2021.

Investment Director Charles Bathurst-Norman discusses the impact of geopolitical conflict and elections on investment markets.

As the US election draws closer, the US S&P 500 Index is in good shape - representing over 70% of global equity markets, writes Investment Director Simon Temple-Pedersen.

US inflation and labour market conditions are looking healthy following the recent US Federal Reserve rate cut, while the UK should be on the path to rate reductions.

Following the Fed's decision to cut the benchmark interest rate, Jon Cunliffe, Head of JM Finn's Investment Office, discusses the implications for markets and investors.

If you like this article, follow us for more insights.

To receive more content like this subscribe today.