Our insights

For decades, the idea that you should sell in May has been an important part of stock market folklore. Brian Tora gives his views on why markets in May have performed better than expected.

What can we expect from the economy over the next few months? Is inflation a big concern? Brian Tora gives his views.

Taking the time to manage your money better can really pay off. We explore what you should be considering in the later stages of life.

As the Duke of Westminster would stand testament, the benefits of trusts are that they can be designed so that the assets held therein do not form part of an individual’s estate, thus providing the…

JM Finn hosted a virtual conference in May, bringing together some experts to share their insights.

Meet Isabel, Investment Manager at our Bristol office. In this video she provides her insight on the biggest challenges for the firm and the growing interest in Environmental, Social and Governance…

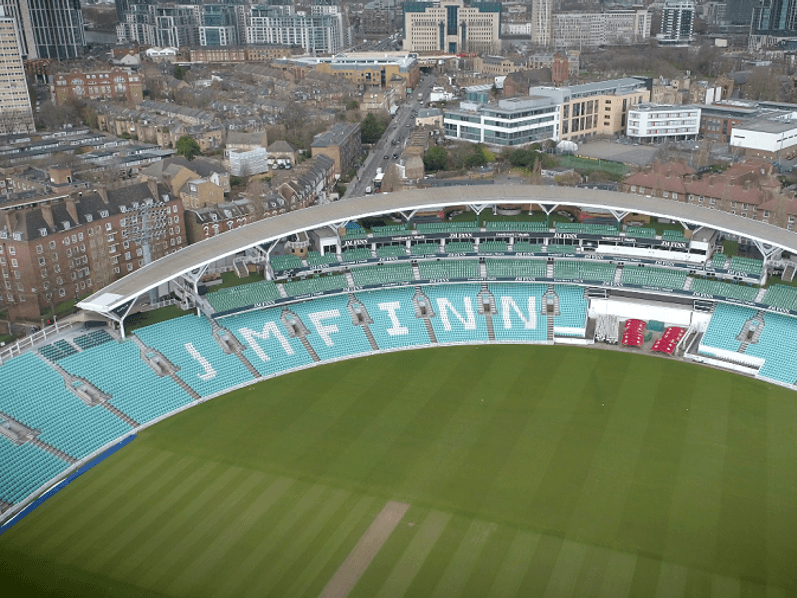

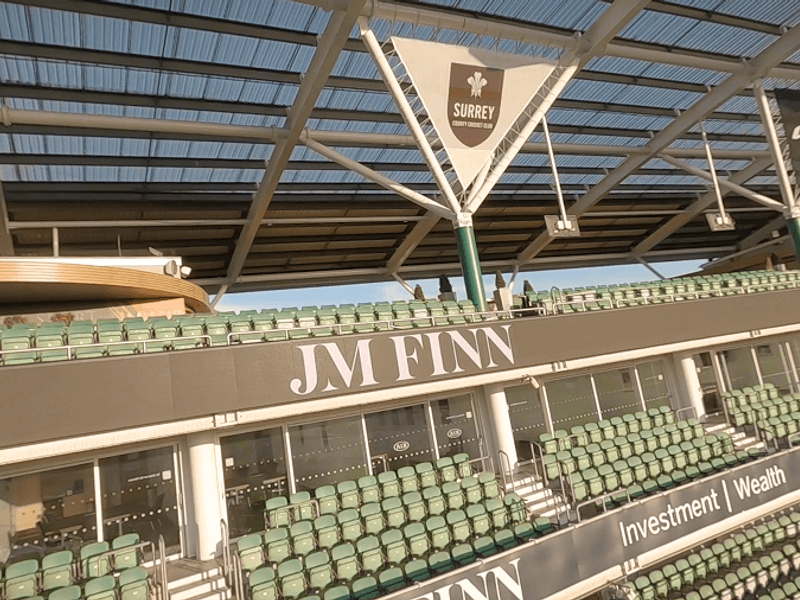

The Vauxhall end stand will now be known as the JM Finn Stand until at least the summer of 2025. In a normal season it will host over 100,000 cricket fans watching sell out Test Matches, One Day…

As investors look towards the rest of the year, this resilient economic backdrop coupled with positive vaccine news has brought another pillar of economic forecasts into focus — pent-up demand. Brian…

The economic outlook for the remainder of 2021 remains uncertain. James Godrich provides his insight on what investors should consider as we return to our new "normal".

James Godrich, fund manager of the JM Finn Coleman Street Investment funds and Ben Beckett, Investment Manager have been included in this year’s list of rising talent in the wealth industry.

JM Finn is holding a virtual conference in May, bringing together some experts to share their insights.

There has been a remarkable dearth of hard news in recent weeks. It’s not that nothing is going on – rather that such stories as hit the headlines are having little impact on investor sentiment.

We are now into the second quarter of 2021 and Brian Tora discusses what he's looking forward to as lock down measures begin to ease.

The Vauxhall end stand will now be known as the JM Finn Stand, extending the partnership for a further five years.

If you like this article, follow us for more insights.

To receive more content like this subscribe today.