Our insights

Henry Birt, Research Analyst at JM Finn, gives an overview of accrual and cash accounting.

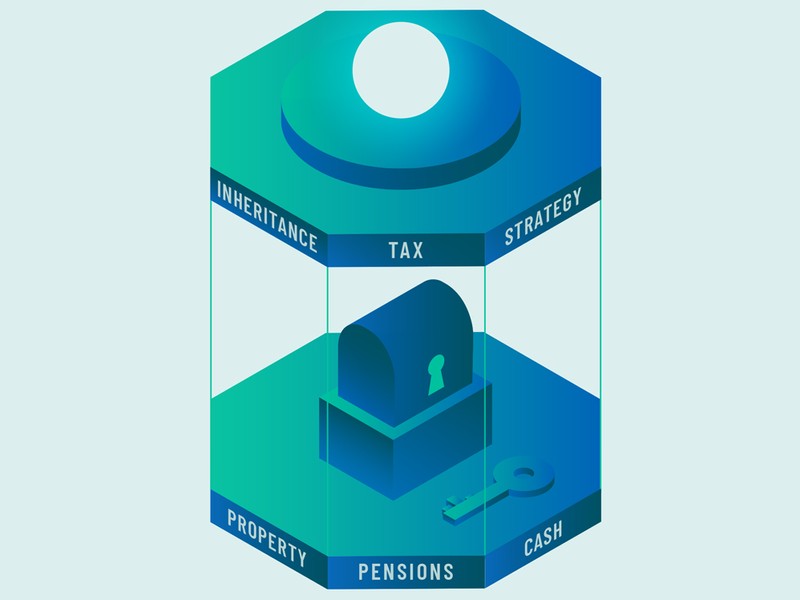

The Autumn Budget threw an unexpected curveball by including pensions in estates for inheritance tax purposes. Ryan Gordon of the JM Finn Wealth Planning team considers the possible impact on…

Sir John Royden, Head of Research, explores the close link between bonds and interest rates in the UK and USA.

Zena Hanks, Partner at Saffery, is a leading authority on personal tax law in the UK. Here, she gives her opinion on the impact of the Budget on the landscape for personal taxation.

As part of our focus on providing a high quality, personalised investment service, we look to support our investment managers in their decision making when it comes to constructing client portfolios.

Meet Rebecca Barrett, Wealth Planner at JM Finn.

The latest message from JM Finn CEO Hugo Bedford in the autumn edition of Prospects magazine.

Amid ongoing elevated consumer prices, early signs are that a tough environment for traditional high street retailers continues despite Black Friday discounts.

A career-focussed generation beset by financial concerns about everything from school fees to retirement planning, they were hit hardest by the financial crisis.

Ignore the media stereotyping, this is the cautious ‘Generation Rent’ who are taking hands-on investment decisions as they strive for financial freedom.

Rising healthcare costs, taxes and low interest rates are prompting even the wealthiest Baby Boomers to question whether they will outlive their money.

As the wealthiest elderly generation ever seen, ‘Traditionalists’ face unique financial challenges as they balance lifestyle with the implications of their longevity.

As they begin their working lives, this optimistic generation looks set to embrace entrepreneurialism while being careful to avoid indebtedness.

Author: Anna Murdock Head of Wealth Planning, JM Finn

If you like this article, follow us for more insights.

To receive more content like this subscribe today.