Our insights

As part of our focus on providing a high quality, personalised investment service, we look to support our investment managers in their decision making when it comes to constructing client…

The wealth management services that we offer are multi-faceted and to get a robust view of how we are doing and, more importantly, what we need to do to continue to meet our clients’ needs, is…

People who have cultivated a huge following on social media ( YouTube, Instagram and SnapChat primarily) have been able to get brands to pay them handsomely to mention a product. The most successful…

James Godrich discusses life as a Fund Manager.

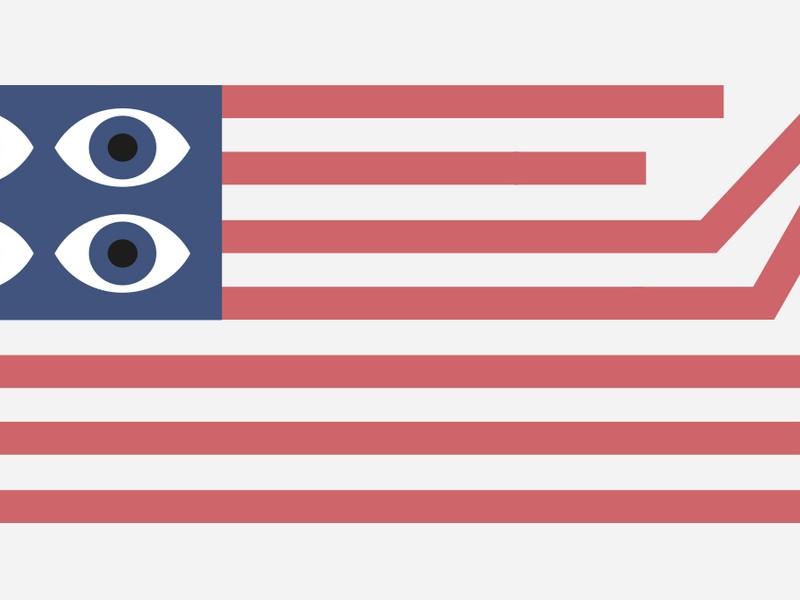

Whilst I don’t think I have the answers to why populism is prevalent now...

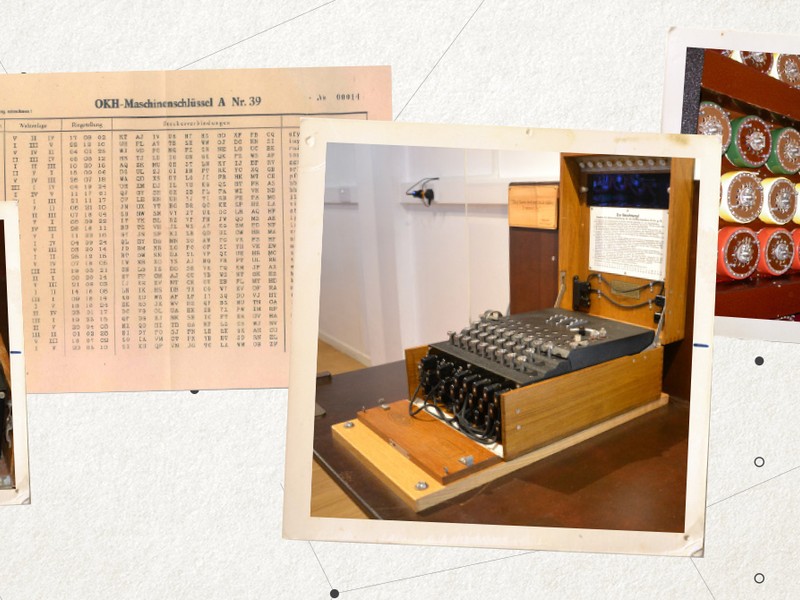

To encrypt a message, the sender's Enigma was set to the key of the day (changing at midnight) and the three scrambling wheels were set to a different start position for each message (sent as the…

My view is that Trump stimulates the economy into the next November 2020 election. With 3.6% unemployment, the lowest level since 1969, the probability is that further economic growth is going to…

A distinguished panel, which comprised the BBC Security Correspondent, Frank Gardner, a senior ex-police officer who had been involved in Counter Terrorism, an American lawyer specialising in…

Yet with consumers and companies unwilling to borrow to fund their consumption or investment, the central bank’s limited ability to stimulate economic growth is clear.Meanwhile, Donald Trump’s use of…

Society is changing, but unfortunately the laws of England and Wales haven’t kept up. A recent poll revealed that a significant number of cohabiting couples mistakenly believe they are ‘common law…

Novo specialises in protein-based medicines. By product segment, revenues split into Diabetes (81%), Obesity (3%), Haemophilia (9%), Growth Disorders (6%) and Other Biopharmaceuticals (1%).Diabetes…

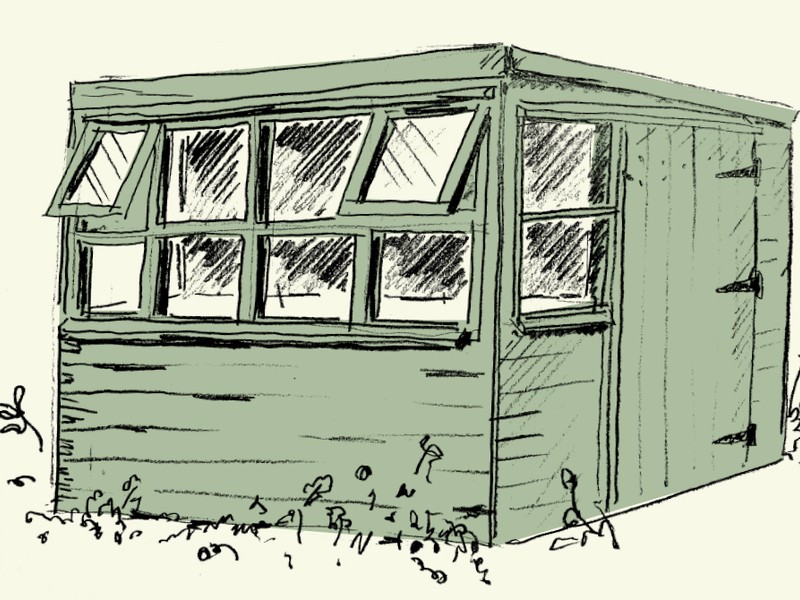

After nine years at my home yard, a field with no mains water or electricity and having just endured one of the longest winters in decades, the thought of another without the little luxury of hot…

In 2012 we saw the launch of auto enrolment pensions in the UK.

If you like this article, follow us for more insights.

To receive more content like this subscribe today.