Our insights

On Wednesday evening two of our Investment Managers hosted an event for 150 guests in the wonderful setting of the Riverhill Himalayan Gardens.

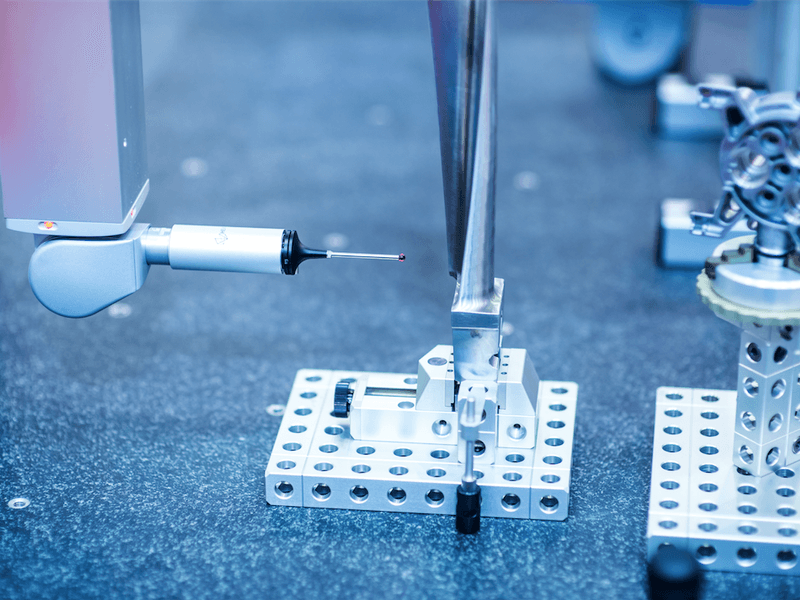

Renishaw aren’t your average FTSE250 Industrial. In 2013, a decision was made that investors would only get to see management twice a year; once at the AGM and once at an investor day, which we…

In 1928 the first Micky Mouse cartoon ‘Steamboat Willie’ appeared in theatres. 90 years later, Walt Disney looks like a very different beast. Media Networks now makes up roughly half of the company…

Tailwise, a platform which helps would-be dog owners to find the right dog from responsible breeders, is the brainchild of Sam Worthy, who founded the business in 2017 following six years of hard…

PZ Cussons (PZ) is a global FMCG company, owning well-known brands such as Imperial Leather, Carex, and Original Source, to name a few.

During the 1990’s, WiFi was invented and began to be commercialised. Those that made the WiFi transmitters were tipped to be the companies through which to play this leap forward in technology.…

There is much speculation surrounding the ‘science’ of profit warnings, their predictability and recurrence in particular. The best publicised being the fabled wisdom that they come in threes.…

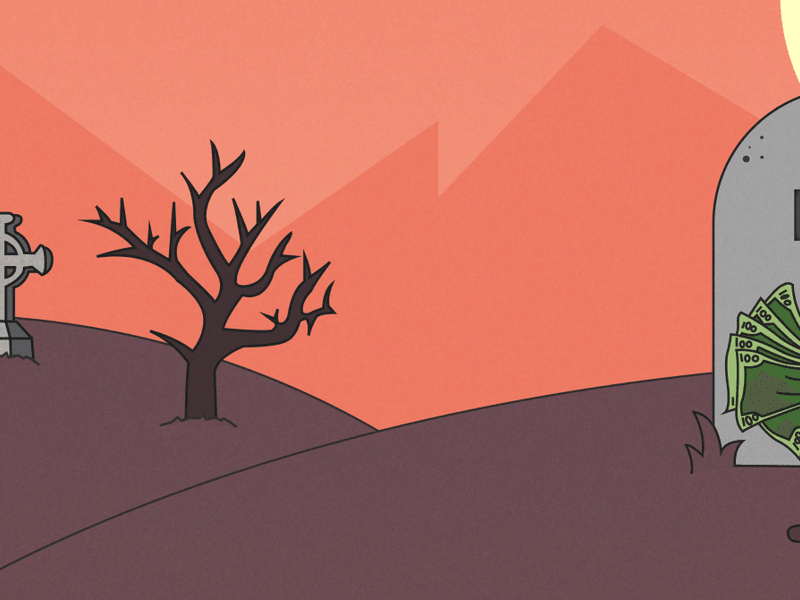

Since April 2015, ISA investors have been able to pass on the value of their tax-free ISA to a spouse or civil partner on death through an ‘additional permitted subscription’ (APS). However, an…

After the pomp and ceremony of the Royal Wedding, Simon Wong, reflects on how a flaw in the Individual Savings Accounts (ISA) rules that prevented surviving partners from inheriting the full amount…

Kim Woolmer discusses life as a wealth manager.

JM Finn Global Conference from Oliver Tregoning on Vimeo.To give our clients some insight into the kind of research that our investment managers and research analysts do on a daily basis, we gathered…

An investment manager’s job is to keep on top of the companies in which they invest on behalf of their clients. This involves more than just following the individual stock, but also keeping tabs on…

Tencent began life in 1998 as an instant messaging service and later, when they listed in 2004, began their expansion outside of social media platforms into online gaming. It was in 2008 when they…

If you like this article, follow us for more insights.

To receive more content like this subscribe today.