It is well known that making a Will is an extremely integral part of Inheritance Tax planning, and by doing so, and keeping it up to date to reflect one’s ongoing wishes, this will ensure that as much as is possible of your Estate goes to those intended.

If you fall in to the camp of being one such individual, currently in the process of updating your Will, please read on. Especially those of you who are altruistically minded and keen to make a bequest to charity.

Gifting to charity has long been a way of legitimately reducing a tax liability, the most common and widespread manner of doing so being via Gift Aid, which can help mitigate an Income Tax liability. In respect of Inheritance Tax (IHT) planning, the value of a gift to charity itself is exempt from IHT. However, a lesser-known tax benefit applicable to charitable gifts is one that was announced by the Government in 2011.

This piece of tax legislation gave rise to the opportunity for an individual to reduce the effective rate of IHT due on their Estate on death. For deaths since 5th April 2012, a 10% reduction to the rate of IHT is given to those who leave 10% or more of their net Estate to Charity. In other words, the effective rate of IHT is reduced from 40% down to 36%.

There is of course no tax benefit to be gained if the Estate is not going to be subject to an IHT charge, but for those whose Estate’s value means that IHT will apply, this is a very valuable and legitimate way of making substantial gifts to the charity/ charities you support, whilst simultaneously reducing the amount of IHT chargeable.

It is also conceivable that an individual might end up leaving a larger share of their Estate to their other beneficiaries as a result of increasing the amount they choose to gift to charity via their Will.

Of course IHT rules are not completely straightforward. The calculation of the value of an individual’s Estate depends on a variety of factors for consideration, such as lifetime gifts, and also perhaps the new “Residential Nil Rate Band”, (RNRB) may be applicable in some circumstances.

As standard, in its simplest form, each individual has a £325,000 amount that would not be subject to IHT on death. This is known as the Nil Rate Band (NRB). It is transferable between spouses, so effectively, a married or civil partnered couple can enjoy an IHT free amount of £650,000 before IHT of 40% is applicable on any excess.

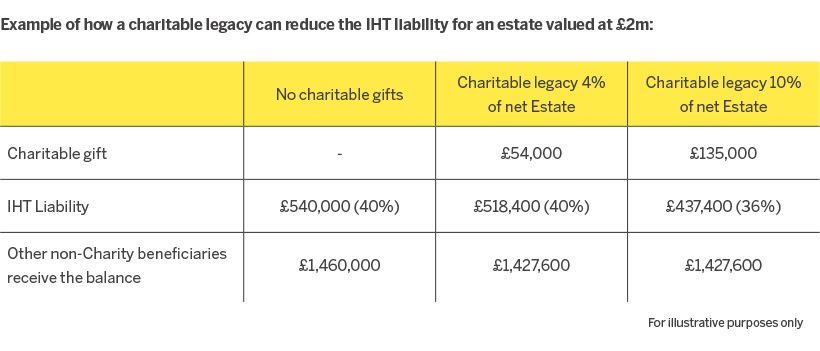

The above scenario assumes a husband and wife with an Estate valued at £2,000,000, have a full £325,000 NRB each available to them, (£650,000 combined). For the sake of simplicity and to best illustrate the point, we have assumed that their Estate does not benefit from any RNRB, and they have each used their £3,000 per annum gift allowance. The example demonstrates the effect of increasing the sum left to charity via the Will from a notional 4% of the net Estate, to 10% of the net Estate instead.

You will see that by increasing the sum gifted to charity, not only does the charity receive a substantially larger sum, (the value of which does not form part of the deceased’s Estate for IHT calculation purposes), the Estate also benefits from the reduction to the rate of IHT from 40% to 36%, and consequently less IHT is payable. The result is that other non-Charity beneficiaries receive exactly the same amount under both scenarios, whilst the charity receives 10% of the net Estate rather than 4%.

Gifting to charity has long been a way of legitimately reducing a tax liability.

If you are wishing to make use of this piece of legislation to benefit your chosen charity, as well as your nearest and dearest, I would suggest engaging your Solicitor who will be able to draft such a bequest into your Will.

There is some guidance on HMRC website at www.gov.uk regarding this subject, including a calculator, but you would be well advised to speak with a Wealth Planner who can offer expert guidance in this area, as well as helping you to look at the whole ambit of other IHT planning methods for consideration.

Of course, this is all on the basis that the rules do not change and it is important to note that a future change in government could result in the removal of this legislation. Your solicitor should be able to advise at the time of writing your Will and on an ongoing basis.

Clare Julian, APFS Chartered Wealth Planner

Meet Clare Julian, Wealth Planner

What was your career path in becoming a chartered wealth planner?

Having read History at University, my Wealth Planning career began as a happy accident. Feeling unchallenged and bored in my first job out of University, I responded to an advert in the Evening Standard. It offered an apprenticeship in financial planning, with the promise of continued development and learning. I joined that firm as a Paraplanner the week after pensions A Day, and so began my journey.

Which aspect of advising clients on their wealth do you find most satisfying?

Very cheesy, but it is so rewarding to see clients happy, having gained real value from the advice you give. I don’t mean in monetary terms necessarily, but rather in them feeling that they are closer to achieving their goals, e.g. retiring at 55, helping with school fees, ensuring their wealth can pass to their family as fully as possible. There is no greater compliment than when having assisted a client, they subsequently refer others to you for advice.

If you were to generalise, which areas do clients most ignore?

Wills. They are the bedrock of Estate Planning and it is surprising how few people have Wills, and of those that do, just how few are an accurate reflection of their current situation and intentions. Additionally, many neglect to use all of their basic reliefs, allowances and exemptions each year.

If you were the Chancellor, what one aspect of our tax system would you change?

The Tapered Annual Allowance. It sends out such an ambiguous message concerning saving for retirement. In particular, it is madness that Senior Clinicians in the NHS are having to choose to work less as they are caught in that trap. I also would love to see an element of financial planning made an essential part of the school curriculum. Many of the families we deal with have the benefit of being able to bring their children and grandchildren up with a mature, responsible attitude to finance. But for the majority, who do not have Investment Managers and Wealth Planners to bring them in to the discussions and meetings over time, many simply do not get that education early on when it is crucial. I think early education would make a real difference to many of life’s challenges, such as the pension funding gap.

To meet one of our Chartered Financial Planners to discuss tax, estate or wealth planning, please contact your investment manager who will be happy to arrange a meeting.

The information provided in this article is of a general nature. It is not a substitute for specific advice with regard to your own circumstances. You are recommended to obtain professional advice from a professional accountant or solicitor before you take any action or refrain from action.

Illustration by Adi Kuznicki