15 years on from that speech, 20 years on from the introduction of central bank independence in the UK and shortly after the first rate hike in ten years, I thought it important to revisit this topic and ask ourselves, ‘has independent monetary policy really been as successful as central bankers might have us believe?’

In 1997 the Bank of England, under the Monetary Policy Framework, were given the task of delivering price stability – defined as a 2% inflation target – in order to provide the ‘right conditions for sustainable growth in output and employment’. To achieve this the Monetary Policy Committee (MPC) were given the tools of setting interest rates and latterly assumed control of the money supply, through quantitative easing.

Whilst this may seem like insignificant financial jargon, particularly to a generation of millennials who have seen little volatility in interest rates, the impact to our everyday lives is tremendous. Interest rates in essence determine the value of money. If rates go up, money becomes more expensive so you can expect to pay more on your mortgage, but at the same time earn more on your savings. And vice versa if rates go down.

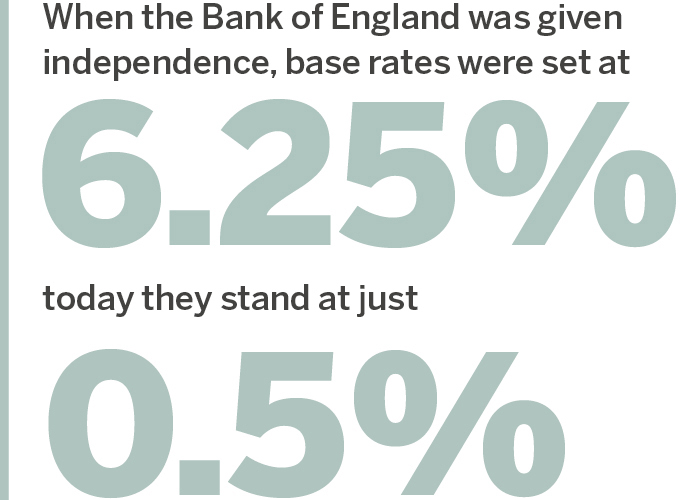

Within this context it is important to note that in 20 years of independence, the Bank of England have met 241 times where they have held interest rates steady 195 times, cut interest rates 27 times and raised interest rates just 19 times. When the Bank of England was given independence, base rates were set at 6.25%, today they stand at just 0.5%. Whilst one may wish to blame this long term decline in interest rates on low inflation, ageing populations and slower productivity growth, empirical evidence tells us that central bank independence has acted mostly to make money cheaper.

At risk of this becoming a history lesson on monetary policy, the obvious question that we must answer is why did the responsibility for setting monetary policy get moved from Whitehall to Threadneedle Street in the first place? The theory goes that the main reasons were that setting rates is a highly skilled, time sensitive job that requires coherent communication with the financial markets which politicians may not necessarily be capable of.

The more cynical amongst us however may argue that it is simpler than this. Low interest rates, set by government officials, means cheap money, resulting in a greater incentive to spend rather than save. This in turn leads to growth in output and employment, which means a more prosperous economy and a greater chance of re-election for politicians. The downside comes from the high inflation that follows as the purchasing power of money begins to dramatically reduce. To see this sequence in action in the UK, we only need to look back to the mid-1960s.

So with the support of both of these theories, and the number of highly skilled, highly qualified and highly educated economists who presented positively on central bank independence during the Bank of England’s recent “20 Years On” conference, who are we to even question its efficacy?

The more cynical amongst us however may argue that it is simpler than this. Low interest rates, set by government officials, means cheap money, resulting in a greater incentive to spend rather than save.

Well, I have two unanswered concerns; the first of which looks at fiscal and monetary co-ordination and the second at whether monetary policy is impacting socioeconomics beyond the Bank of England’s current remit.

The period since the global financial crisis has been a prime example of a lack of fiscal and monetary co-ordination; by that I mean that we have seen a sustained period of fiscal austerity, through public sector pay caps and limited government spending, alongside an historic period of ultra-loose monetary policy through zero rates and quantitative easing. If I were to ask two people stood side-by-side to move a sofa and one of them chose to push whilst the other chose to pull, how much progress would be made? None.

Ironically, now that we are finally seeing a loosening of the Government’s purse strings as the Conservatives look to lift pay-caps and increase infrastructure spending, it has come at the same time as monetary tightening.

Whilst the risks associated with too much Government intervention are clear to see, it appears that too little could also be an imperfect solution.

A second consideration is around the socioeconomic impact of the cheap money that has been a feature of the 20 years of central bank independence, and the profound impact that it has had on asset prices and wealth inequality. In his book, The Only Game in Town, former PIMCO CEO and co-CIO Mohamed A. El-Erian argues that a return to global growth requires, amongst other things, prosperity across the social spectrum. With zero rates driving stock markets, house prices and debt instruments ever higher it must be asked whether the existing structure will ever allow for one of El-Erian’s key conditions to be met.

I believe that monetary policy, in its current existence, is heading slowly towards an abrupt T-junction

As the risks from widening inequality and little policy co-ordination begin to outweigh the benefits of stable prices in providing the ‘right conditions for sustainable growth in output and employment’, I believe that monetary policy, in its current existence, is heading slowly towards an abrupt T-junction. One turning sees central banks raise rates to normalise monetary policy, whilst maintaining steady global growth. The other sees dwindling credibility, the proliferation of the phrase ‘central bankers bubble’ and all the macroeconomic risks that come with this loss of confidence.

Successful navigation I believe, requires constant monitoring not only of the central bankers sat in the driving seat but of the machinery and infrastructure that they are being given to drive, and 20 years on, what better time than now?

Illustration by Matt Glasby