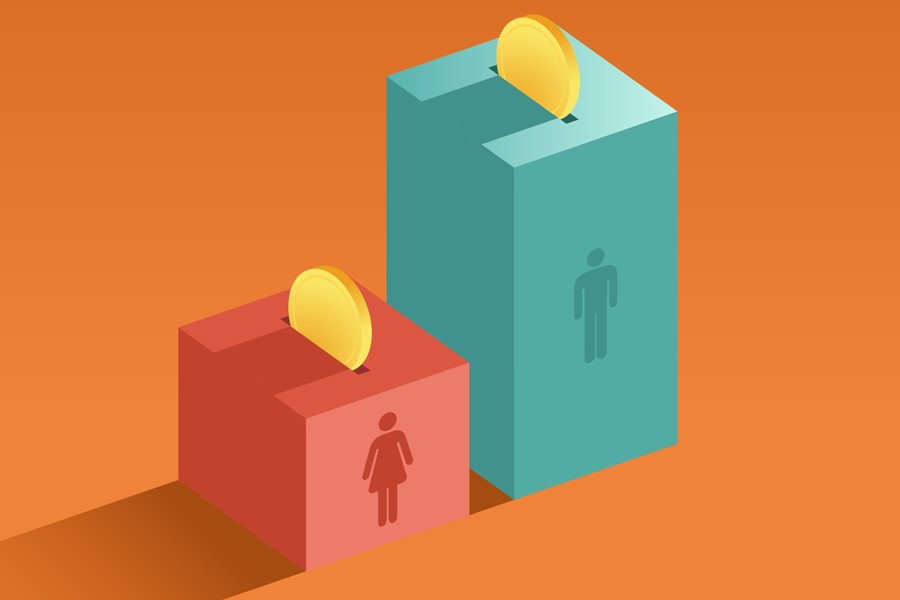

This huge sum is calculated on the basis that 3.3 million more men in the UK than women hold investments. There are myriad reasons for the gap; leaving employment to raise children can mean reduced pension pot sizes, while the continued heavy use of jargon by the finance industry can be offputting to many women – leaving them with the sense that investing is not for them.

Career breaks causing pension pot disparities

A large difference in the average size of pension pots held by men and women is a key contributing factor to this gender

disparity in investments. Time out to raise children is among the main causes; although many firms now make it possible to share parental care, it is often the case that women take the lion’s share of time away from work to raise children: 53% of women take career breaks compared to only 1% of men. This gap in women’s working lives, combined with lower average salaries can often have a large impact on the size of women’s pension pots compared to men: the most recent UK government data available (2018-2020) shows a gender gap of 35% between male and female pension sizes.

Jargon can be a sticking point in female perception of the finance industry

At 17%, UK women have a lower propensity than men (26%) to hold any investments in equities – a trend that is mirrored elsewhere in the world. Common reasons are a lack of confidence when it comes to investing – with only 1 in 10 women saying they understand investing.

One of the main reasons for this lack of confidence is the still pervasive use of unnecessary jargon within the finance and

investment industry. Partly to tackle this, the Financial Conduct Authority (FCA) introduced a new principle in 2023 called

Consumer Duty. Under this legislation it is now compulsory for finance firms to ensure their material can be understood by all their clients and prospective clients regardless of their level of financial knowledge – it is now no longer acceptable to assume understanding by a hypothetical ‘average client’. While this new law should go some way to unshrouding the industry

of its air of mystery and gravitas in written communications, it is also important for finance companies to adopt plain English as the default wherever possible.

Lower risk appetite among women can lead to preference for cash ISAs and savings accounts

Another factor in the gender investment gap is that women on average are more risk-averse when it comes to investing: according to FCA research 82% of women describe themselves as having a low appetite for risk, compared with 69% of men. Combined with a lack of understanding and knowledge of the industry, investing in general may be viewed by many women as risky. This perception means that women are likelier to opt for more familiar types of saving that they may perceive as being lower risk: 37% use a cash ISA. FCA research shows women are also 1.3 times more likely than men to have a savings account. Ironically, in the current climate of inflation at elevated levels in the last few years, cash accounts are unfortunately typically a risky way to have kept money – as keeping large amounts held in cash during periods of high inflation can often mean its value declines in real terms.

Lastly, recent high-profile press around highly risky unregulated investments like cryptocurrencies, such as the 2022 collapse of the crypto exchange FTX may lead many people to believe that these volatile and unregulated investments are what is entailed in investing. They are also unlikely to have done much to encourage female perceptions of investing as being a viable and safe option for them. There is arguably a place for greater education of consumers– both on the potential benefits of investing compared to holding money in cash, and the differences in likely risk between the regulated investment

industry and unregulated investments like cryptocurrencies.