Cash flow modelling allows you to plan ahead, and make appropriate steps now in the hope that your life-time consumption is as smooth as possible.

Cash flow modelling works by predicting what your future income and expenditure will be, based on numerous assumptions. In making these future predictions, we can consider what measures you should be taking now, in order to ensure that by the time you retire you are safe in the knowledge your desired lifestyle can be supported. Although, as we have seen in recent times, future predictions are never 100% accurate, we can use regular cash flow modelling to influence the actions we need to make now.

There are many reasons why cash flow modelling is useful for financial planning. For example, it enables effective estate planning. Parents are able to gift away assets when their children require additional funding, such as their first property deposit, and know that they can do this without affecting their overall lifecycle consumption. Efficient estate planning is knowing when you are able to pass on your wealth at the best possible time, whilst maintaining your own current and future living standard. This is why cash flow analysis can be helpful, as it gives a rough idea as to when is best to begin the unwinding process.

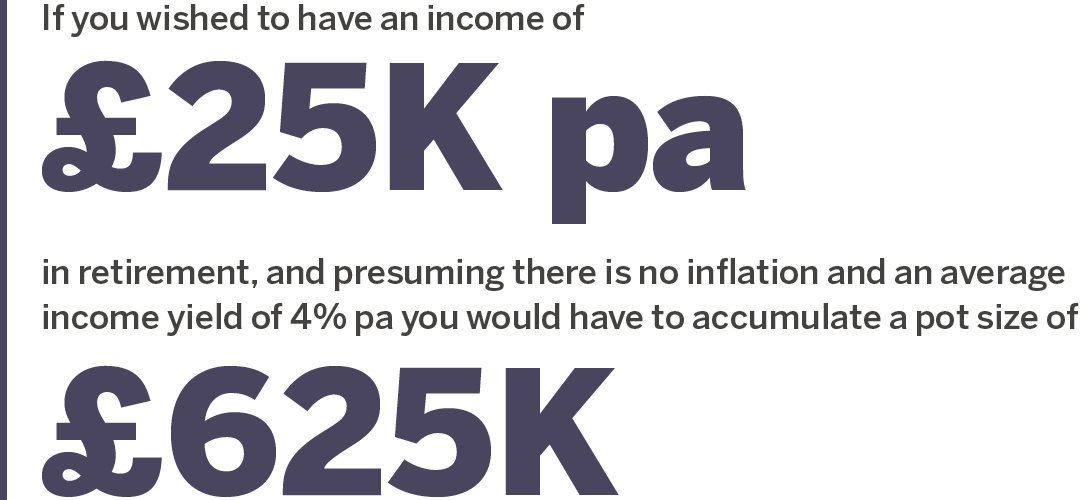

Another reason as to why life time cash flow modelling can be useful, is that it provides an indication of what size pension pot an individual needs to accumulate before they can retire. By taking into account what size pot you need to have the desired level of income when you retire, you can work out when you can afford to retire and maintain your standard of living.

If you wished to have an income of £25,000 pa in retirement, and presuming there is no inflation and an average income yield of 4% pa, you would have to accumulate a pot size of £625,000 which would be the minimum needed to maintain this level of income. Clearly this is a very simple example, however cash flow forecasting can go into much greater detail, giving a greater foresight as to what you need to work towards when you retire. The financial planning insight as well as the investment insight complement each other to aim to reach the target.

At JM Finn we offer not just a bespoke discretionary service, but also personal wealth planning too.

At JM Finn we offer not just a bespoke discretionary investment service, but also personal wealth planning. These two offerings in combination allow one to make the most effcient use of your wealth. For example, as one gets older and starts to have children, you may need to supplement your income. In such a case their investment objectives change from growth to income and growth. This can be forecast using the cash flow model, and the easy communication between the wealth planners and investment managers makes this a seamless transition. Clearly we cannot predict the future however, what we can do is put in precautionary measures as to what we expect to happen at any given stage of one’s life. Cash flow modelling may seem a dry topic, however it is a powerful tool to assist in getting the most out of your capital. It has the ability to tailor your investments to your current and future needs. But what is key, is it can adapt as your life adapts, and still aim to make the best use of your capital.

The points made in this article are for illustrative purposes only and if you require any assistance with any of the above opportunities in relation to your personal circumstances, contact your investment manager who can make an introduction to our specialist wealth planning team.