What is it?

Your Investment Manager will start with a blank canvas to design an investment portfolio for you from scratch that is tailored uniquely to meet your needs. The strategy will be determined based on your attitude to risk.

Who is the service most suitable for?

Our bespoke investment service is most suited to private clients, charities or trusts who have more complex wealth needs such as existing Capital Gains Tax considerations or holdings of sentimental value that they wish to keep. Those with higher amounts to invest may also prefer to opt for their own bespoke portfolio.

Ability to actively manage Capital Gains Tax for existing liabilities

If you have an existing bespoke portfolio with another provider, it can be transferred ‘in specie’ to the JM Finn Wealth Management Service – meaning that you would not incur Capital Gains Tax from selling the holdings. This is a significant advantage for those who would otherwise face significant Capital Gains Tax charges.

Flexibility

As the portfolio is created from scratch, it allows you to add any specific investment restrictions into the portfolio, such as sectors or companies you prefer not to invest in.

Accommodate ‘cherished’ holdings

You may, for example hold shares with sentimental value, such as inherited shares or shares in a company you have previously worked in. The Wealth Management Service can incorporate these existing holdings into a portfolio.

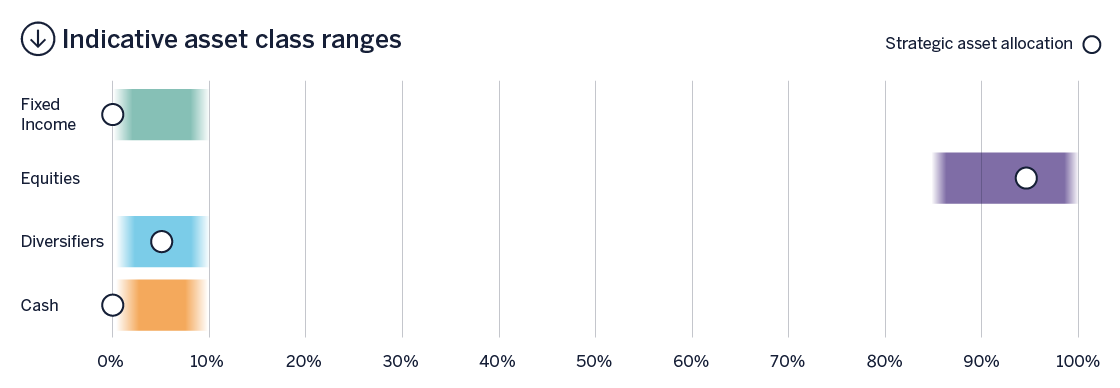

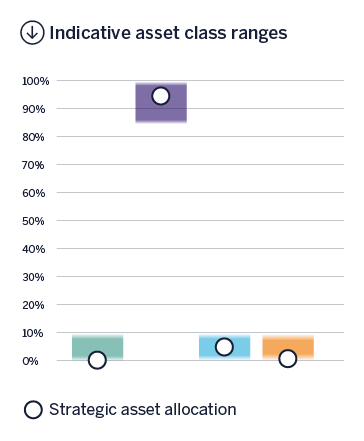

We offer a range of five risk strategies, which differ from each other by the amount of exposure they have to four core asset classes, to help you understand the investment outcome you might expect based on the level of risk you take. Our primary measure of risk is determined by your portfolio's exposure to equity investments; generally, the more equity exposure, the higher the risk, and of course, the higher the potential for greater returns.

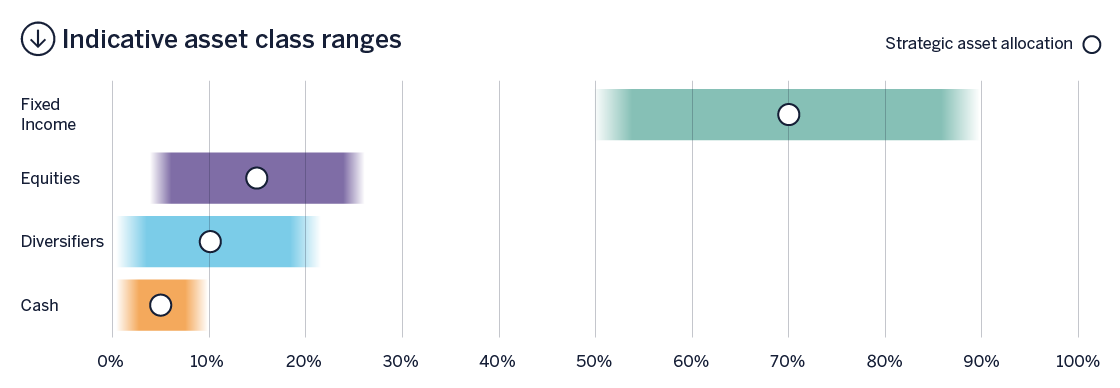

Cautious

This is our lowest risk strategy and may be suitable for an investor with a low risk tolerance looking to generate a return over time which exceeds the return available on cash deposits.

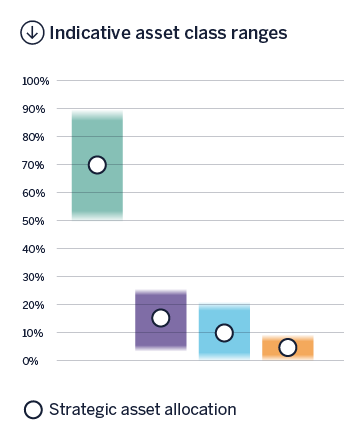

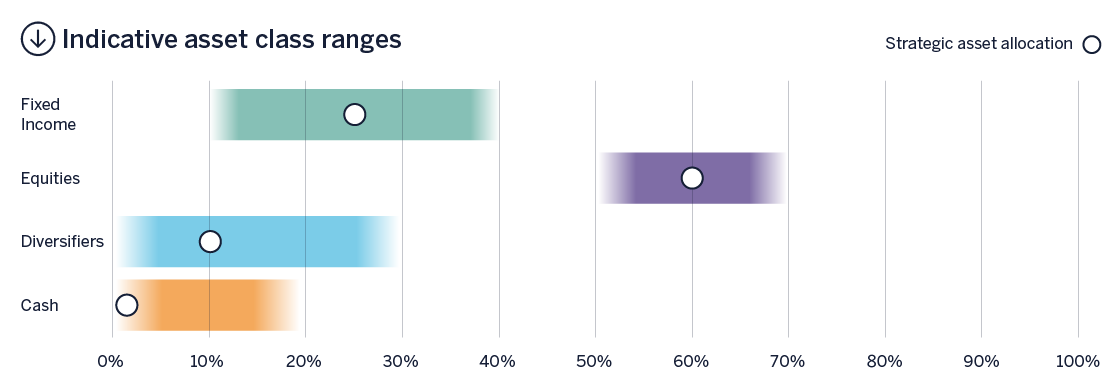

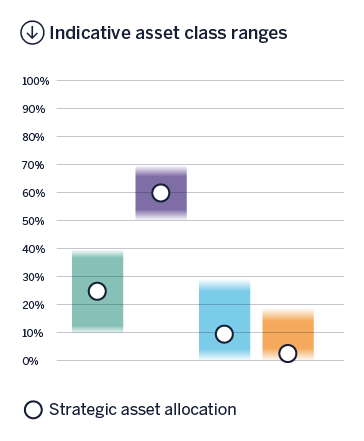

Conservative

With moderate exposure to equity investments this strategy represents low risk and can be suitable for investors looking for a return and willing to accept a degree of loss.

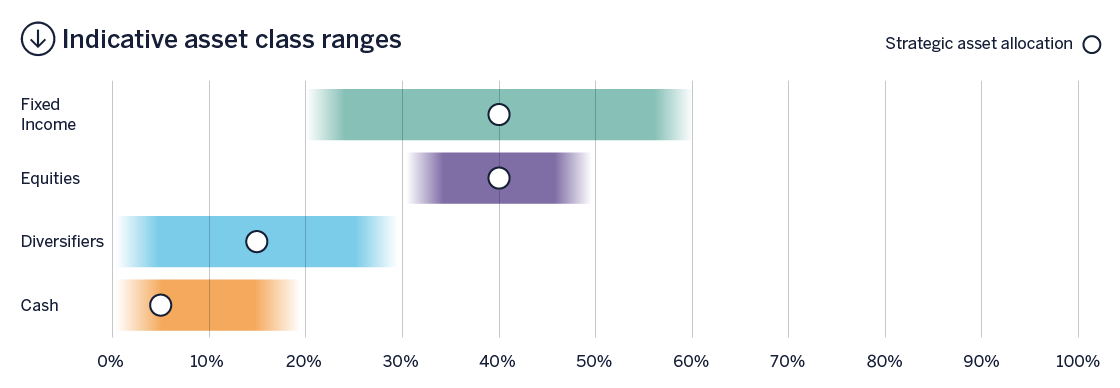

Moderate

A higher and significant exposure to equities offers the potential for greater returns but places a higher level of risk on the investment. Clients in this strategy must be able to accept at least a temporary loss of capital.

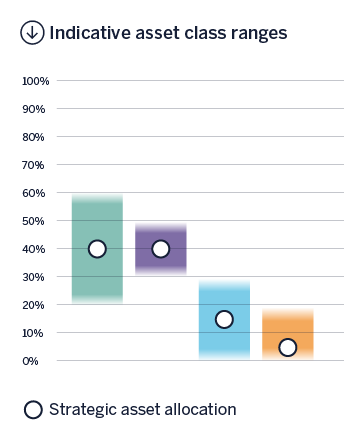

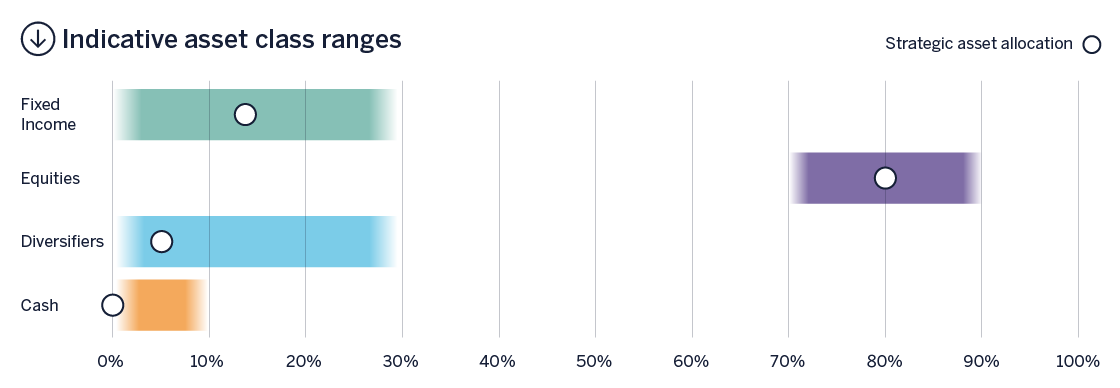

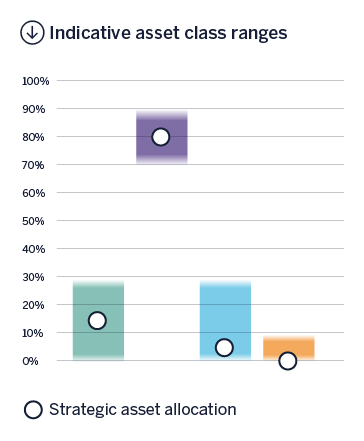

Progressive

With an anticipated 80% of the portfolio invested in equities, this might be suitable for those investors looking to grow their assets but able to tolerate a high risk of losing their capital.

Adventurous

This is the highest risk strategy, with almost all of the portfolio invested in equities. This can be suitable for long-term investors willing to accept a meaningful loss of capital in return for greater returns.

Wealth Planning

As a client of the Investment Management Service, you’ll have access to the benefit of our highly-rated Wealth Planning Service*. Offered on a no-obligation basis, our Wealth Planning team can help guide you through many financial challenges, working with your investment manager and external third parties to review your financial situation and develop an appropriate strategy.

*Our Wealth Planning Service is chargeable on a separate basis.

More information

To learn more about our Wealth Management Service please download a copy of the Wealth Management Service brochure, Wealth Management Service Investment Strategies and Risk brochure.

Wealth Management Service

Wealth Management Service

Investment Risk and Strategies Guide

Investment Risk and Strategies Guide