US$5trn

The annual rise in female controlled wealth globally. There is also a long-term trend in the UK towards women owning more wealth.

£599bn

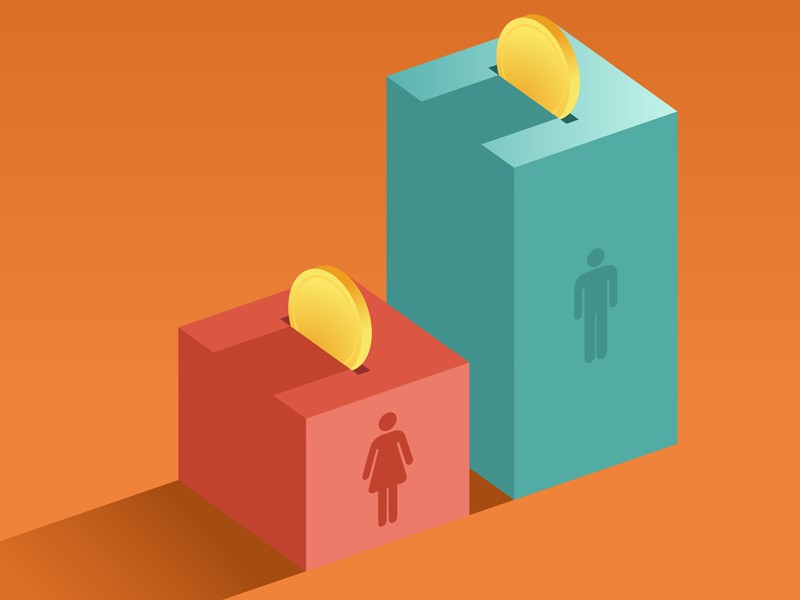

The gender investing gap in the UK. While women are closing the wealth gap, they are still less likely than men to invest or use financial planning.

1 in 10

Women who say they understand investing: reasons for the low proportion include the use of jargon by the finance industry.

Introduction

Among the reasons for the rise in female-held wealth are life events such as inheritance and divorce, as well as more women founding their own companies or reaching the top of their organisations: the video will delve further into each of these factors. Women are more likely than men to be risk-averse and to hold their money in ways that are traditionally seen as ‘safe,’ such as cash – yet this approach may often not be the best; investing wealth and structuring it to make the most of tax reliefs are important steps to try to preserve it for the long term.

Watch wealth planner Rebecca Barrett cover the key points around the rise in women’s wealth.

Consultant Katie Larnach takes a closer look at the ways in which the financial behaviours of affluent women are rapidly changing.

Despite women gradually closing the pay gap and advancing in the world of work, they are still far less likely than men to invest money: and this is contributing to a staggering £599 billion…

Everyone’s wealth journey is different and depends on their personal objectives and circumstances. However, there are common experiences that women face, which can have a significant impact on their…